tax deferred exchange definition

Ad The Leading Online Publisher of National and State-specific Legal Documents. Known as 1031-exchanges after the section of the Internal Revenue Code permitting their use the exchanges offer landowners tax advantages over traditional land sales.

1031 Exchange What Is It And How Does It Work Plum Lending

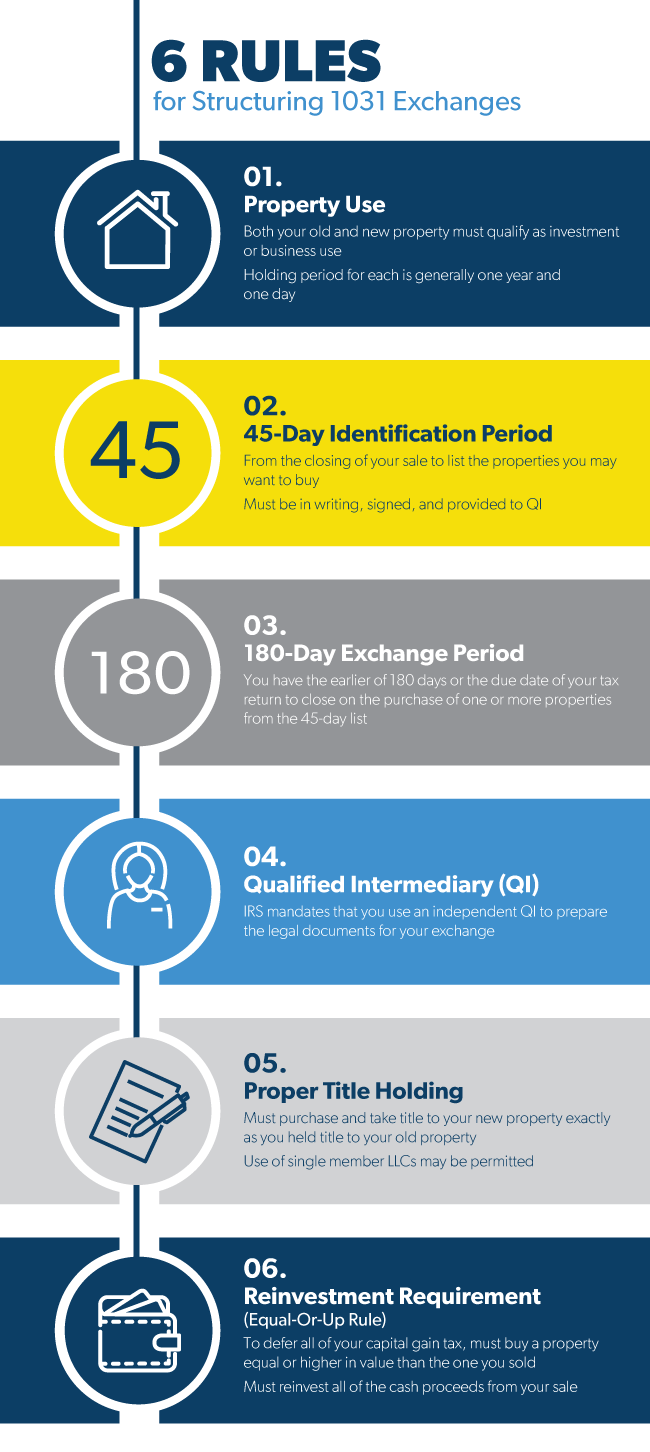

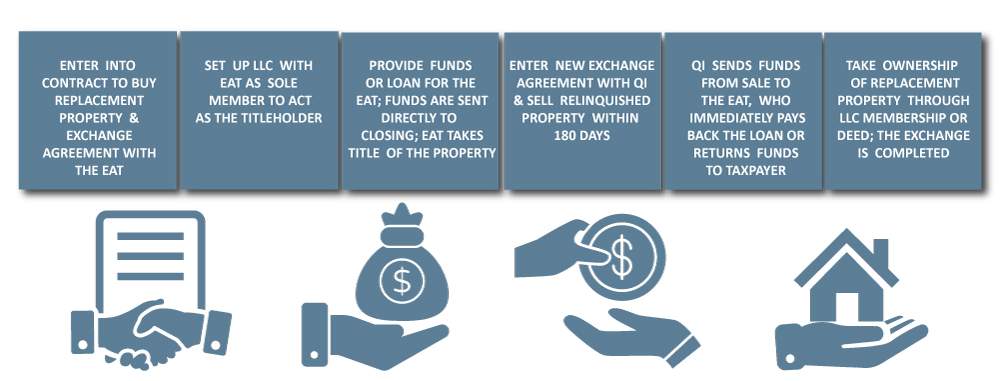

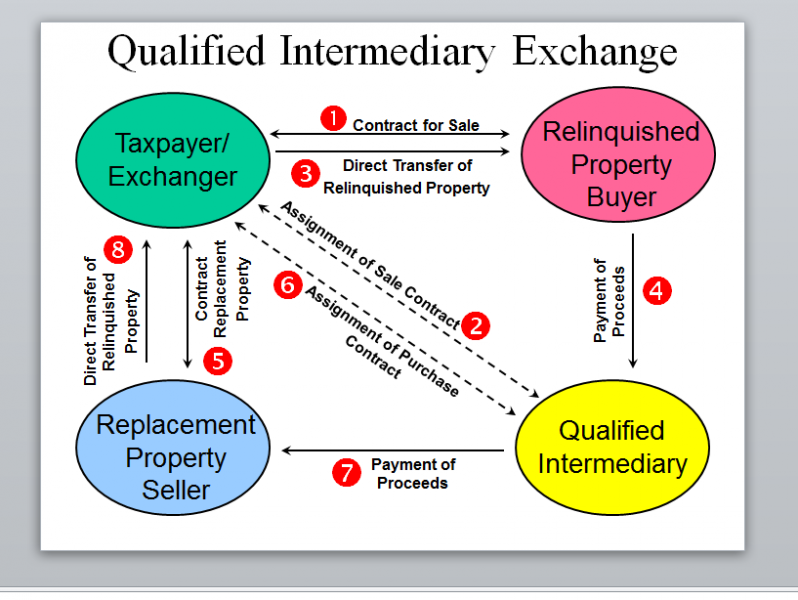

If a lender is used to provide the loan be sure the lender is familiar with the Reverse 1031 Exchange process.

. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. Equity Advantage is available to consult with your lender. Legal Definition of tax-deferred.

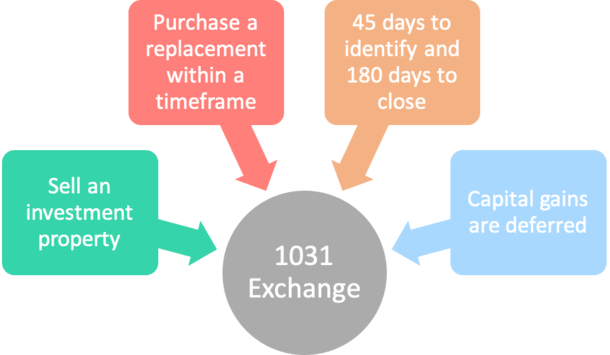

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. Sometimes people say tax-free exchange but thats NOT accurate because the tax is only deferred until the day you sell the property and choose not to invest the money into a new one. In a 1031 exchange the seller of appreciated property may exchange appreciated.

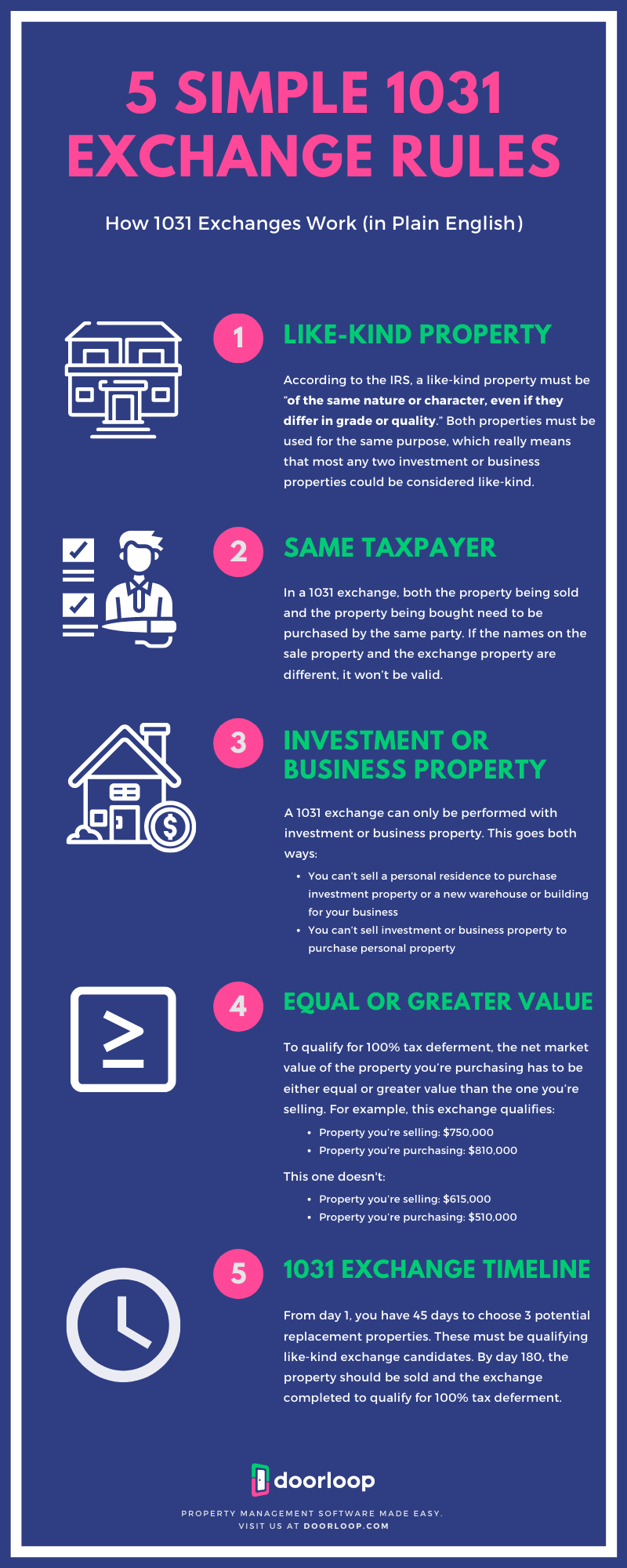

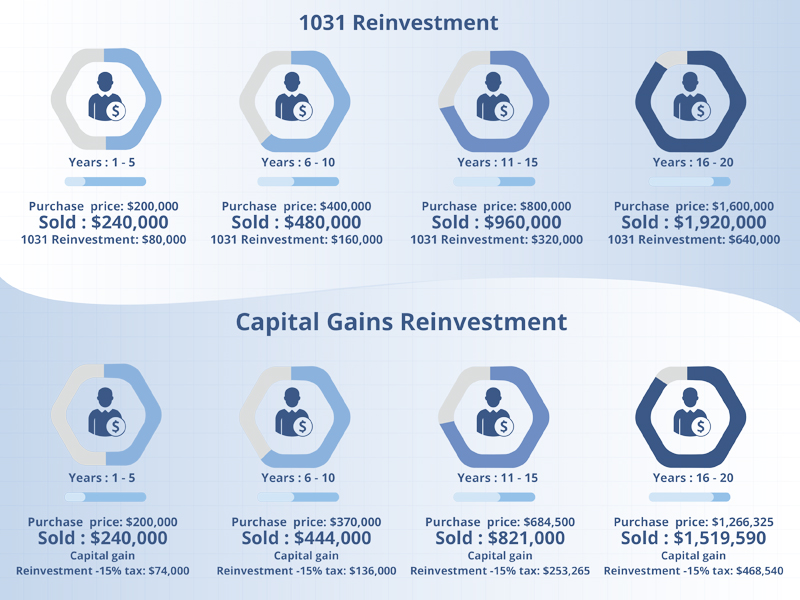

A tax-deferred exchange permits taxpayers to delay paying capital gains taxes on the disposition of property traded for like-kind property. IRS Code 1031 allows real property to be exchanged for other real property without the immediate payment. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement property.

1 This property exchange takes its name from Section 1031 of the Internal Revenue Code. Those taxes could run as high as 15 to 30 when state and federal taxes are combined. Internal Revenue Code 1031.

In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange. The Complete Real Estate Encyclopedia by Denise L. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

Handling earnest money deposits in a 1031 Exchange The company also offers strategic advisory asset management tax-deferred exchange and capital markets solutions. The termwhich gets its name from Section 1031 of the Internal Revenue. Property for other real property of like kind to avoid paying taxes on the gain.

Not taxable until a future date or event as withdrawal or retirement. Deferred exchange financial definition of deferred exchange deferred exchange deferred exchange The correct name for a real estate transaction which is often erroneously called a tax-free exchangeSee 1031 exchange. The gain may be taxable in the current year.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. What is a 1031 exchange. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today.

A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. How Do I elect to complete a 1033 exchange. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain.

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. The exchange allows for the deference of any taxable gains on the. Get Access to the Largest Online Library of Legal Forms for Any State.

Negotiate terms of the purchase. Establish funding to acquire your replacement property The funds may come from your exchange personal funds or a banklender. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several relinquished properties for one or more like-kind replacement properties and defers the tax.

Section 1031 is a provision of the Internal Revenue Code IRC that allows a business or the owners of investment property to defer federal taxes on some exchanges of real estate. However if the property is subject to an involuntary conversion the taxpayer has the ability to defer the payment of the depreciation recapture and capital gain taxes on the involuntary conversion under the non-recognition provisions of Section 1033. Evans JD O.

A 1031 Exchange is an exchange of like-kind properties that are held for business or investment purposes in the United States. Of capital gains tax. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity.

1031 Tax Deferred Exchange Explained Ligris

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

What Is A 1031 Exchange Properties Paradise Blog

1031 Exchange How You Can Avoid Or Offset Capital Gains

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange When Selling A Business

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

The State Of 1031 Exchange In 2022 Old Republic Title

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

What Is A 1031 Exchange Asset Preservation Inc

Are You Eligible For A 1031 Exchange

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah